Read our list of “Independent Heroes” who all made significant contributions to world history well into their “senior” years–On the 4th of July, Americans will celebrate 238 years since we as a nation declared our independence. Over those years the average age and life span of Americans has grown considerably. In 1776, the average life expectancy in America was 35 years. In 2014, the average life expectancy is now 76 for men and 81 for women. Life expectancy has more than doubled and quality of…

Senior Care Blog

What you need to know about the Veterans’ Aide & Attendance Benefit for Long Term Care and How to Apply

Since 2007 , Life Care Funding has worked with families in need of financial help for long term care. Many of the people we have helped served in the military and were able to also benefit from Veteran’s Aide and Attendance supplemental income. It always means a lot to us when we can help a family– and it is especially meaningful to us when we know we are helping someone who served our country in the military. It is also very meaningful to me on a…

June 15th is World Elder Abuse Awareness Day

Elder abuse is a real problem in the United States and the most prevalent form of abuse is financial. In a post Life Care Funding put on this BLOG back in 2012, we shared information that was released on this subject by the Assisted Living Federation of America (ALFA) putting numbers behind the severity of this problem: “In a national survey of state securities regulators, financial planners, health care professionals, social workers, adult protective services workers, law enforcement officials, elder law attorneys, and academics 79…

How Men Can Help Guard Against Poverty in Their Golden Years

June is Men’s Health Month, a reminder for men to do the things that they generally don’t do as well as women: getting screened for conditions that, detected early, are easily treated; seeking education about health issues, and supporting each other’s well-being. If being happier with good health isn’t enough, then men should consider the extraordinarily high medical cost of poor health – especially during the retirement years, says insurance industry expert Chris Orestis. “Just one health incident can wipe out an individual’s savings, leaving…

What are the advantages of a Long Term Care Benefit Plan?

Instead of allowing a life insurance policy to lapse or be surrendered; the owner of the policy can convert the policy into a Long Term Care Benefit Plan. A Long Term Care Benefit Plan is the conversion of an in-force life insurance policy into an irrevocable, FDIC-insured Benefit Account that is professionally administered with tax-free payments made monthly on behalf of the individual receiving care. Policy owners have the legal right to convert an in-force life insurance policy to enroll in the benefit plan, and…

Life Care Funding website is a FREE resource for families to connect with Senior Care providers

Life Care Funding is not only a resource to help fund Senior Living and Long Term Care, but we are also a resource to help families find the best care providers in the United States. We are proud to work with a network of over 5,000 providers of Home Care, Assisted Living, Memory Care, Nursing Home and Hospice services across the country. Families looking for financial resources to pay for care will find many answers to their questions by watching the three minute animated “chalk-board“ video…

How a life insurance policy can fund your client’s long-term care

Opinion // April 22, 2014 // Chris Orestis // The costs of long-term care are increasing every year, but most families do not understand what they will be confronting when it is their time to start paying for care. Too many people wait until they are in the midst of a crisis situation before they start trying to figure out how the world of long-term care works. Agents and advisors confront this reality every day. People want to remain financially independent and in control of…

New E-Book, ‘Help on the Way,’ Explores Long-Term Health-Care Funding

* Pay for senior care with life insurance * Home Care, Assisted Living, Nursing Homes * Learn from real family stories * Know your rights * Tips: Medicare, Medicaid, Assisted Living, Home Care PORTLAND, Maine – Chris Orestis, senior health-care advocate and CEO of Life Care Funding, (http://ebook.lifecarefunding.com/),has published a new free e-book, “Help on the Way,” which details the slowly unfolding crisis happening now in the United States: a “Silver Tsunami” of aging Americans with no way to pay for long-term care. Since 2011,…

States continue to endorse Life Care Funding’s Long Term Care Benefit Plan as a way to help people pay for their choice of Senior Care

Life Care Funding is proud that states across the country are endorsing our Long Term Care Benefit Plan to help families pay for Senior Care. Twelve states have introduced policy conversion consumer disclosure legislation to educate policy owners about the option to sell a life insurance policy to fund a Long Term Care Benefit Plan and remain private pay. It also codifies the Long Term Care Benefit Plan structure that protects the funds and ensures they will only be used to pay for long term…

Did you know it is quick and easy, and there are no fees to enroll in a Long Term Care Benefit Plan?

Term life, Universal life, Whole life and Group life all qualify to be converted into a Long Term Care Benefit Life Care Funding does not charge any fees and there are no obligations to apply The application is a very short form that takes about 5 minutes to complete Life Care Funding does not charge any fees and there are no obligations to apply for the Long Term Care Benefit Plan. The application is a very short from that takes about 5 minutes to complete….

Did you know a Long Term Care Benefit Plan is not a loan on the policy or Long Term Care Insurance?

A Long Term Care Benefit Plan is not long term care insurance And it is not a policy loan that costs fees and interest and must be paid back The policy owner is actually obtaining the maximum present day value of the policy and protecting the funds in an irrevocable Benefit Account A Long Term Care Benefit Plan is not long term care insurance, and it is not a policy loan that costs fees and interest and must be paid back. When a policy owner…

Did you know a Long Term Care Benefit Plan is a Medicaid qualified spend-down that helps a policy owner stay private pay as long as possible?

A life insurance policy is an asset of the policy owner and it counts against them when applying for Medicaid Assisted Living and Private Duty Homecare do not accept Medicaid or Medicare Converting a life insurance policy into a Long Term Care Benefit Plan is a Medicaid qualified spend-down A life insurance policy is an asset of the policy owner and it counts against them when applying for Medicaid. But, by converting an existing life insurance policy to a Long Term Care Benefit plan,…

Did you know any type of life insurance policy can be converted to pay for any form of long term care?

All types of life insurance can qualify to be converted into a Long Term Care Benefit including term life policies, whole life, universal life and group life The Benefit will pay for Homecare, Assisted Living, Memory Care, or Nursing Home and Hospice care The Benefit Plan is designed to be flexible to meet the changing needs of care Every senior care provider in the country accepts the Long Term Care Benefit Plan All types of life insurance can qualify to be converted into a Long…

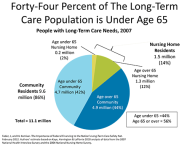

Did you know that 10,000 Baby Boomers turn 65 every day and that 70% of them will need long term care in their lifetime?

The monthly costs of Homecare or an Assisted Living community can easily reach $5,000 Long Term Care insurance won’t cover this and neither does Medicaid Converting a life insurance policy into a Long Term Care Benefit Plan is an often overlooked solution Families across the United States are struggling with how to pay for the costs of long term care. Not enough people plan for the almost certain eventuality that they will need to pay for long term care for themselves or a loved one. …

Did you know Medicare and Medicaid will only cover certain types of long term care?

Learn the differences between Medicare and Medicaid Medicare is for people over the age of 65 that will cover the first 100 days of rehabilitation in a nursing home if a person is discharged from a hospital Medicaid is for people below the poverty line that meet medical and financial requirements to qualify for care in an approved nursing home Some Homecare can be covered by Medicare and Medicaid if the person meets the eligibility requirements People are often confused about the differences between Medicare…