The Long Term Care Commission Deadline of September 12 is Rapidly Approaching Life Care Funding CEO, Chris Orestis joins panel of experts and submits formal Medicaid Life Settlement policy paper to The Congressional Commission on Long-Term Care The Congressional Long-Term Care Commission will submit final recommendations to the President of the United States and the Congress on September 12th, 2013. Chris Orestis, CEO of Life Care Funding was one of the national experts on Senior Care and Finance to submit a written policy recommendation to…

Posts tagged "Cost of Care"

Chris Orestis on The News and Experts Radio Show

Chris visits the The News and Experts show on Money Monday to talk about state legislation, insurance companies, and how you can take advantage of your life insurance policies. Chris was recently on The News and Experts radio show and had a fantastic interview. Chris went over several major issues in the life insurance industry, and explained how Life Care Funding is in the process of solving them. But Something we’re all unsure about is how the Life Insurance companies have been reacting to seniors…

Cost of Care, Insurance Conversion, Insurance Settlement, interview, radioChris Orestis Radio Tour Teaches the Public about using Life Insurance Policies to Pay for Care

Life insurance industry expert, Chris Orestis, goes on a nationwide radio tour to inform seniors of new possibilities to help pay for long term care. Chris is working to get the word out to seniors and their families that they can use a life insurance policy to pay for long term care whether home care, assisted living or nursing home care. Many seniors who need care have to go through a Medicaid spend down to qualify for Medicaid which means they must use a Medicaid…

Cost of Care, Financial Assistance for Seniors, Long Term Care, Medicaid, Senior CareLong Term Care Insurance

If the Long Term Care Insurance Market Collapsed, How are Seniors going to Pay for Care? In 2000, there were over 100 Long Term Care Insurance Companies and today there are maybe a dozen What happened? In less than 15 years the long term care insurance market has almost disappeared. Major insurance companies such as MetLife, Prudential, UNUM, and the Guardian have quite the market and no longer sell policies. The only companies left have been forced to raise premiums on families that bought policies…

Cost of Care, Financial Assistance for Seniors, Insurance Conversion, Long Term Care, Long Term Care Cost, Long Term Care Insurance, Senior IssuesLong Term Care Commission takes on the Long Term Care Funding Crisis

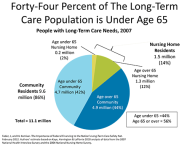

Life Care funding is aware of the troubles the US government’s Long Term Care Commission and Medicaid will be soon facing with long term care, and we have a solution. The Long Term Care Commission appointed by Congress to study and make recommendations about the rapidly escalating crisis facing Americans and their ability to pay for long term care, met for the first time in Washington, DC on Thursday, June 27th and the Long Term Care Commission’s prognosis was dire. It has long been known that…

Cost of Care, Long Term Care, Long Term Care Cost, Long Term Care Insurance, Medicaid, MedicareAvoid Life Insurance Loans and Credit Programs

Seniors beware of life insurance loan and credit funding programs that could disqualify you from future Medicaid eligibility. Seniors that own life insurance policies can convert their death benefit into a living benefit to help pay for Senior Care Services. The practice of converting a life insurance policy into a Life Care Benefit has been an accepted method of payment for Private Duty In-Homecare, Assisted Living, Skilled Nursing, Memory Care and Hospice Care for years. Instead of abandoning a life policy because they can no…

Consumer Protection, Cost of Care, Elder Care, Financial Assistance for Seniors, Insurance Conversion, Medicaid, Senior Life InsuranceFamily Converts Term Life Policy to Pay For High Cost Assisted Living

Family converts term life policy to cover the gap of a long term care insurance policy and move their father to a new assisted living community. The daughter contacted Life Care Funding because their father was residing at a facility, but the children were not happy with it and wanted to move him. The costs were going to be higher at the new community, and although he had a long term care insurance policy he did not yet qualify for the coverage to begin. The…

Assisted Living, Cost of CareHusband and Wife use Life Insurance Policy to Pay for Assisted Living

Trading-in two Life insurance policies cover outstanding balance in arrears and monthly expenses for husband and wife. The business office of an assisted living community in the Life Care Funding “Trusted Partners” network called about a couple that was currently in residence. They had limited income and were in arrears with a growing unpaid balance. They both have LTC policies but the husband does not yet qualify for benefits to start. They were receiving limited benefits from the wife’s LTC policy but it was not…

Cost of Care, Senior LivingApplicant’s Son Inquire About Converting a Life Insurance Policy

The applicant’s son called to inquire about trading-in a life insurance policy they were planning to abandon. His mother was unable to live at home alone any longer and they were looking into Assisted Living but needed financial help. Their mother owned a $100,000 life insurance policy. He completed a Life Care Funding application and submitted it along with policy information, authorizations and medical records. The family moved their mother into the Assisted Living community she was hoping to reside in with a number of…

Assisted Living, Cost of CareFamily Caregiver Provides Financial Support to Loved Ones Despite Limited Resources

Care Improvement Plus and National Family Caregivers Association survey underscores the growing demands placed on those caring for loved ones with complex health care needs BALTIMORE–(BUSINESS WIRE)–Seventy-five percent of people caring for Medicare beneficiaries with complex health care needs have an annual income of less than $25,000, yet a majority provide financial support to their loved one, according to a new survey by Care Improvement Plus and the National Family Caregivers Association. Financial worries, diabetes care and care coordination are among the greatest challenges facing…

Cost of Care