Use Your Life Insurance Policy to Pay for Long-Term Care Leaders from the Long Term Care Industry, Life Settlement Industry, and Law Makers Speak Out in Favor of Using Life Insurance to Pay for Long Term Care Using your life insurance to pay for long term care is easy, because consumers have the legal right to convert their life insurance’s death benefit into a living benefit that can be used to pay for Long Term Care services. Homecare providers, Assisted Living communities, Nursing Homes, and…

Posts tagged "Long Term Care Cost"

Chris Orestis on The Mary Jane Poppoff Show

Chris does it again in a long interview on the Mary Jane Poppoff Show. Mary and Chris talk about how Life Insurance can benefit you before you die. Chris recently went on the Mary Jane Poppoff Show and had an interview filled with information about Life Care Funding. Mary Popp asked some great questions which covered everything from state legislation to funeral coverage. A topic in the interview was about funeral benefits. With a Long Term Care Benefit plan, money is set aside for future…

Economic Crisis, interview, Long Term Care Cost, radio, Senior Life InsuranceLong Term Care Insurance

If the Long Term Care Insurance Market Collapsed, How are Seniors going to Pay for Care? In 2000, there were over 100 Long Term Care Insurance Companies and today there are maybe a dozen What happened? In less than 15 years the long term care insurance market has almost disappeared. Major insurance companies such as MetLife, Prudential, UNUM, and the Guardian have quite the market and no longer sell policies. The only companies left have been forced to raise premiums on families that bought policies…

Cost of Care, Financial Assistance for Seniors, Insurance Conversion, Long Term Care, Long Term Care Cost, Long Term Care Insurance, Senior IssuesLong Term Care Commission takes on the Long Term Care Funding Crisis

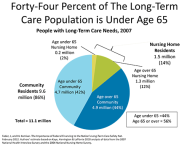

Life Care funding is aware of the troubles the US government’s Long Term Care Commission and Medicaid will be soon facing with long term care, and we have a solution. The Long Term Care Commission appointed by Congress to study and make recommendations about the rapidly escalating crisis facing Americans and their ability to pay for long term care, met for the first time in Washington, DC on Thursday, June 27th and the Long Term Care Commission’s prognosis was dire. It has long been known that…

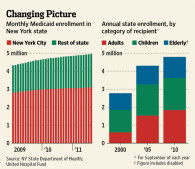

Cost of Care, Long Term Care, Long Term Care Cost, Long Term Care Insurance, Medicaid, MedicareNew York Medicaid Life Settlements

Legislative Overview: Medicaid Life Settlement conversion of a life insurance policy into a Long Term Care Benefit Plan NEW YORK STATE ASSEMBLY, SENATE HEALTH COMMITTEE BILL NUMBER: S5721 As New York becomes the eighth state to introduce legislation to promote Medicaid Life Settlement conversions of life insurance policies into Long Term Care Benefits, and Texas becomes the first to enact this legislation into law, Life Care Funding was asked to provide some insight and commentary into what this new law means for consumers seeking the…

Elder Care, Financial Assistance for Seniors, Life Insurance Settlements, Long Term Care Cost, MedicaidThe Medicaid Life Settlement Plan

Medicaid Life Settlement Laws Victory! State laws supporting your right to convert a life insurance policy to pay for Homecare, Assisted Living and Nursing Home Care pass around the country So far in 2013, eight states have introduced legislation based on Life Care Funding’s Long Term Care Benefit program as a way to encourage more use of Private Pay Solutions for Homecare, Assisted Living and Skilled Nursing through the conversion of a life insurance policy into a Medicaid Life Settlement Plan. This practice is already…

Assisted Living, Home Care, Life Insurance Settlements, Long Term Care Cost, Medicaid, Nursing HomeSearching for Private Pay Solutions as the Long Term Care Funding Crisis Worsens

Unprepared for the Future Americans are doing little to prepare for long term care and are not very concerned. And maybe they don’t need to be concerned— because they need to be terrified! A recent poll released by AP-NORC Center for Public Affairs Research, and reported in the national media, verified a major factor contributing to the long term care funding crisis in this country: Two out of every three people over the age of 40, according to the poll, have made no plans about…

Long Term Care, Long Term Care Cost, Senior Issues, Senior Life InsuranceFamily Uses Insurance Policy to Help with a Medicaid Spend Down

A policy is converted to spend-down for Medicaid and a family recovers out of pocket expenses. Their father was suffering from Parkinson’s Disease and needed to move into a nursing home. He owned a $100,000 life insurance policy that counted against him for Medicaid eligibility. The nursing home referred him to Life Care Funding to trade-in in his policy for a Long Term Care Benefit Plan. The family had also spent some money on his care at home as they were looking for the right…

Financial Assistance for Seniors, Long Term Care CostWhat is a Long Term Care Benefit Plan?

* Convert a life insurance policy into a monthly benefit for Senior Care in as little time as 30 days * All forms of Senior Care qualify: Home Care, Assisted Living, Memory Care, Nursing Home, and Hospice * Term Life, Universal Life, Whole Life and Group Life policies all qualify * Benefit is flexible and can be adjusted as care needs change * Final expense benefit * No fees and no premium payments A Long Term Care Benefit Plan is a unique, tax advantaged financial…

Elder Care, Long Term Care Cost, Long Term Care InsuranceEmeritus Senior Living: Long Term Care Benefit Instructional Videos

Check out these two videos produced by About.com and Emeritus Senior Living about using Life Care Funding’s Long Term Care Benefit to pay for Senior Care– About.com: Paying for Long Term Care Benefit Using a Life Insurance Policy// Emeritus: How to Use a Life Insurance Policy to Pay for Senior Living// Life Care Funding’s program converts the death benefit of an in-force life insurance policy into a Long Term Care Benefit. Qualifying for the benefit is quick, uncomplicated, and can be done in as little time as 30…

Insurance Conversion, LifeCare Partnerships, Long Term Care Cost